A Hypothetical Journey Through Corruption and Reform

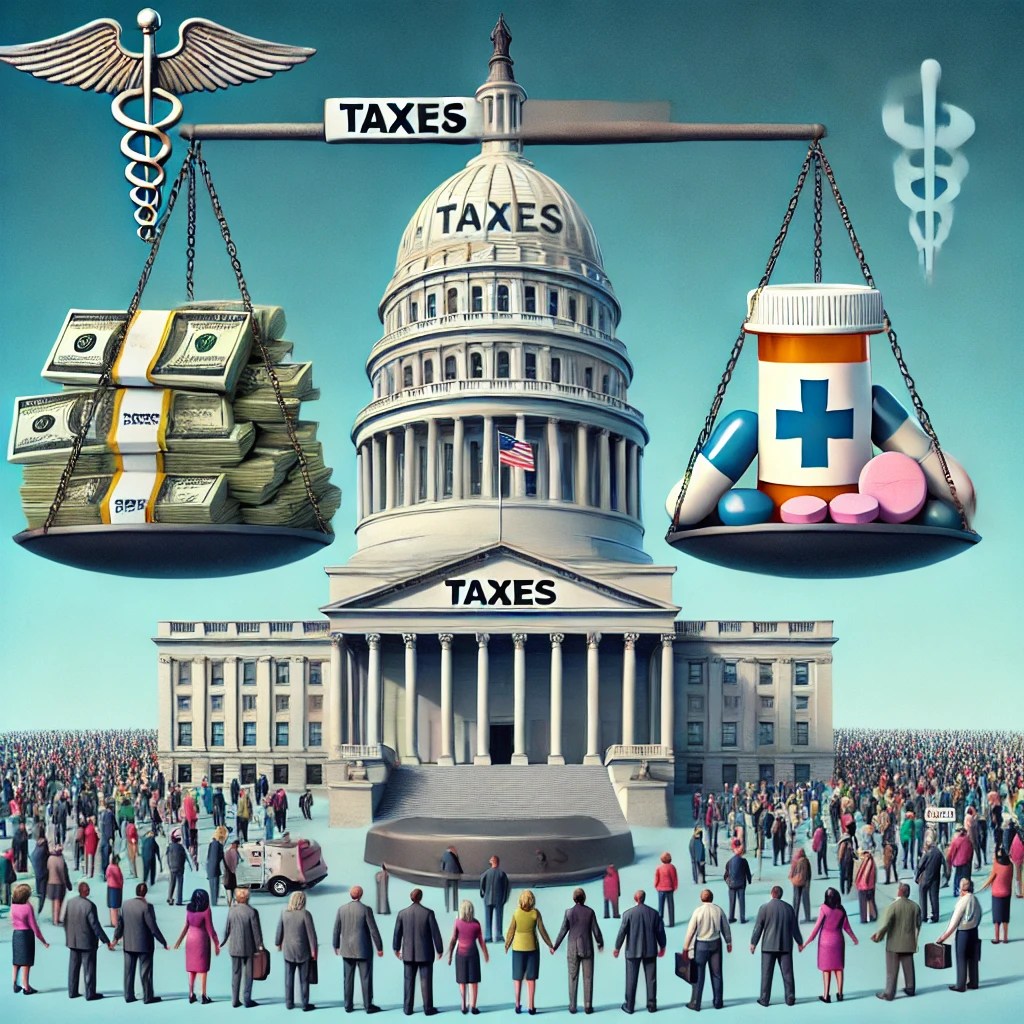

Imagine a world where taxes don’t serve the needs of the people but instead fund the promises of political elites. In this place, hard-working citizens watch their earnings siphoned off to support policies that seem far removed from their daily struggles. Healthcare, pharmaceuticals, and government regulations become a tangled web that works against those it’s meant to protect. How did we end up here? More importantly, how do we escape it?

Taxes, in theory, are meant to provide essential services: roads, schools, hospitals. But when they become a tool of political agendas, resentment builds. Imagine a scenario where employees, after putting in long hours to earn bonuses, see a huge portion of their reward disappear into taxes. What if bonuses up to $50,000 were tax-free? It might be just the incentive people need to keep pushing forward. Without such relief, many feel they’re being punished for success.

Then there’s healthcare—dominated by profit in this hypothetical world. Pharmaceutical giants dictate prices, not based on need, but on market demand. Life-saving medications become inaccessible for many. Some even fear that secretive labs are creating new pathogens just to profit from the vaccines they develop to fight them. While these fears might seem extreme, they point to a real need for transparency and oversight in medical research.

Imagine a global system where labs and pharmaceutical companies are held accountable by independent regulators. Publicly funded research could take priority over corporate profits, shifting healthcare’s focus back to people rather than balance sheets. That shift might also alleviate the stranglehold insurance companies have on patients. In this scenario, insurers inflate costs in collaboration with healthcare providers, making even minor medical procedures financially devastating.

What if governments introduced tax breaks for preventive care or wellness programs? People could invest in their own health without breaking the bank. Regulations could rein in insurance companies, ensuring fair pricing and comprehensive coverage. But reform isn’t easy when governments themselves are part of the problem.

In this world, political leaders often campaign on grand promises they can’t afford. The result? Higher taxes and rising national debt. Citizens feel betrayed, seeing little benefit from the money they’re forced to contribute. A new approach might focus on lean governance—cutting waste, prioritizing essential services, and giving citizens more control over how their tax dollars are spent.

Trust needs to be rebuilt. Imagine a future where conflicts of interest are exposed, where independent audits ensure tax money is used responsibly, and where experts can debate openly without fear of suppression. Transparency and accountability aren’t just buzzwords; they’re the cornerstones of a healthy democracy.

Innovation must also be protected. Reducing barriers to research and entrepreneurship can unlock solutions to society’s biggest problems. Governments don’t need to stifle creativity to maintain oversight; they just need to enforce the rules fairly.

The challenges of taxation, healthcare, and insurance are deeply interconnected. Mismanagement can spiral into corruption, leaving ordinary people disillusioned and overburdened. But it doesn’t have to be this way. With smarter policies and a renewed focus on the public good, societies can find a better balance. Fair taxation, accessible healthcare, and economic freedom are not mutually exclusive. The future depends on leaders who remember that governance is meant to serve the people, not weigh them down.

Leave a comment